In a brief period of only eight working days, from 2nd to 13th May, the experienced IppStar Survey team of researchers exceeded their target of 200 responses from printers, packaging converters, brand owners, and suppliers. The answers show that the industry is a resilient and hopeful community but also realistic. Although prudent and optimistic of recovery once the lockdown ends, the industry is clearly unsure of how the Covid-19 virus will play out in the country.

While packaging printers and converters are, understandably, more optimistic, commercial printers are somewhat pessimistic. Commercial printers are feeling the overhang of weak demand and enormous cash flow problems for at least four quarters preceding the pandemic. No payments have been forthcoming since the lockdown began on 22nd March, not even those that generally arrive at the end of the financial year on 31st March.

A strong stratified sample

Significantly, a broad range of equipment and consumable suppliers also responded to the IppStar quick survey on recovery from the Covid-19 lockdown. While printers made up 49% of the respondents, 23% were packaging printers and converters. Brand owners made up just over 13%, including a few who also have packaging plants. The balance 15% consisted of input suppliers of equipment, consumables, and services. This latter category includes manufacturers, importers, distributors, and a few service providers in logistics. There are some overlaps in categories also.

The offset and digital commercial printers respondents include book, digital photo book, newspaper, and magazine printers. The brand owners, print buyers, packaging printers, and converters surveyed are mainly active in the food, beverage, healthcare, and personal care sectors. Fewer respondents represented the apparel, foot-ware, and electronics sectors.

Our industry is not happy about working from home

Only half of our respondents have been working from home. This should not come as a surprise because it has been difficult to get permission to open plants and to organize around the other constraints to run them. Supply chain issues and transport and logistics unavailability are cited by 68% of the respondents as the main challenges. The shortage of raw materials is given by 38%, while the lack of workforce comes fourth but is still a significant 35% of the responses. The print and packaging industry is not happy about working from home (many find it meaningless when they have a factory to run), and only half of those working from home found it an ‘ok’ experience.

Expectations of contraction for FY 20-21

A significant number of respondents to the IppStar survey were either frank enough to say that they don’t know what to expect in the coming year, or perhaps didn’t want to be publicly negative. However, 62% of the printers, converters, brand owners expect their FY20-21 turnovers to be much less than in the previous year.

While a tiny minority feel that the drop will be 10% or lower, 28% expect a decline of 10 to 30%. Another 30% of the respondents think that the decrease in turnover in the current financial year will be more than 30%.

As far as the perception of when the lockdown will lift, (keep in mind that the IppStar survey took place mainly between 4 and 13 May) half the respondents say they have no idea, which is a sensible answer. The other half was more hopeful in thinking that it could be lifted from anywhere between 7 to 30 days. Of this half, the overwhelming percentage feels that the lockdown will end in 14 to 30 days. In other words, when they filled out the survey, they expected the lockdown to be appreciably mitigated between end-May and mid-June.

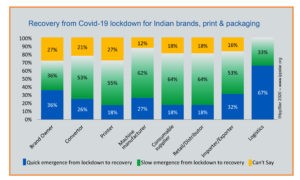

On the recovery of the Indian print and packaging industry from the pandemic and lockdown, more than half, 53% expect a slow emergence and recovery. There is a considerable number, 23% on average across sectors, who are hopeful of a quick recovery – perhaps what is described by economists as a V-shaped recovery. Some packaging converters expect a speedy recovery, while others feel it will take time for the economy and demand to pick up. The logistics sector is the most optimistic about a quick recovery.

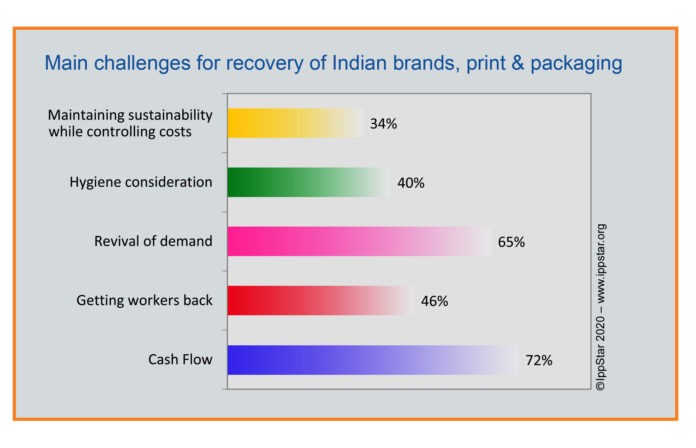

Challenges to recovery in print and packaging

The biggest challenges to the industry’s recovery are seen as cash flow, by 72% of the respondents, and demand revival by 65%. Getting employees back is seen as a significant challenge by 46% of the respondents, and maintaining hygienic conditions by 40%. The problem of improving sustainability while under pressure to control costs is acknowledged by 34% of the respondents.

Transport unavailability and supply chain issues topped the challenges for businesses during the lockdown. Raw material shortage was seen as a slightly more significant challenge than a lack of human resources.

Majority endorses government steps

The majority of respondents, just over 70%, said they were satisfied by the government’s initiatives taken for the smoother functioning of business and operations in the face of the Covid-19 outbreak. By and large, this seems to be an endorsement of the government’s measures and actions, including the lockdown. However, a significant minority of 18% said they were not satisfied by the government’s measures, while another 12% were bold enough to say the government actions were not particularly effective or helpful.