The following is a summary of the business inflation expectation survey (BIES) of May 2020, which has been regularly done by the Indian Institute of Management Ahmedabad since May 2017, currently with around 1300 respondents. Notes on the survey are given below.*

1. As the lockdown of the economy due to the ongoing Covid-19 pandemic was partially lifted, the number of firms participating in BIES for May 2020 has improved. Also, the survey instrument could be reverted to the full questionnaire as against a shortened questionnaire implemented in April 2020. Accordingly, the survey results are presented for inflation expectations and perceptions about cost, sales and profit.

2. One year ahead, business inflation expectations in May 2020 have declined marginally by 13 basis points to 4.24% from 4.37% reported in April 2020. However, they continue to remain over 4% for the past three consecutive months.

3. Over 37% of the firms perceive that the current cost increase is over 6%. However, 1/5th of the firms still perceive that the current cost increase is over 10%.

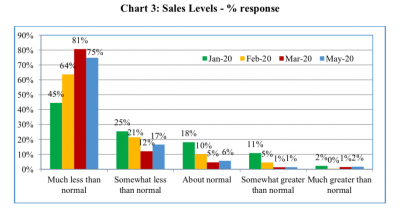

4. Around 92% of the firms in the sample, report that sales are ‘somewhat or much less than normal’ as against 93% reporting in March 2020. A very similar story is revealed for profit margins. So there is very little change in perceptions – pessimism continues to dominate business performance.

5. Past reports are available at https://www.iima.ac.in/web/faculty/faculty-profiles/abhiman-das. All aggregate data is also made available on the website.

*The Business Inflation Expectations Survey (BIES) provides ways to examine the amount of slack in the economy by polling a panel of business leaders about their inflation expectations in the short and medium-term. This monthly survey asks questions about year-ahead cost expectations and the factors influencing price changes, such as profit, sales levels and other parameters. The survey is unique in that it goes straight to businesses – the price setters – rather than to consumers or households, to understand their expectations of the price level changes.

One major advantage of BIES is that one can get a probabilistic assessment of inflation expectations and thus get a measure of uncertainty. It also provides an indirect assessment of the overall demand condition of the economy. Therefore, the results of this Survey are useful in understanding the inflation expectations of businesses and complement other macro data required for policymaking. With this objective, the BIES was introduced at IIMA from May 2017. The BIES questionnaire is finalized based on the detailed feedback received from the industry, academicians, and policymakers. A copy of the questionnaire is available. Companies are selected primarily from the manufacturing sector. The ‘BIES – May 2020’ is the 36th round of the survey. These results are based on the responses of around 1300 companies. RBI Chair Professor in Finance and Economics, Abhiman Das is the faculty responsible for this survey.