Kodak has published its figures for the financial year ending 31 December 2024, which show a mixed outlook, with some notable successes but also areas of continuing concern. Fortunately I met with Kodak’s CEO, Jim Continenza, at last month’s Hunkeler Innovation Days. Our conversation preceded these results but will still help to fill in some of the detail behind the figures.

So, for the full year, Kodak recorded revenues of US$ 1.043 billion, which is 7% down on the previous year’s US$ 1.117 billion. Kodak has attributed US$ 3 million of this to foreign currency changes. The gross profit fell 3% to US$ 203 million, compared with US$ 210 million for the full year 2023, while the gross profit percentage of 19% was flat when compared to the prior year.

The year-end cash balance was US$ 201 million, down from the US$ 255 million at the end of the previous year, which Kodak says is mainly driven by capital expenditures primarily to fund growth initiatives, investments in technology systems and organizational structure. The figures also show lower profitability from operations, though this was partially offset by improvements in working capital, mainly from US$ 40 million in brand licensing in the first quarter of 2024. Otherwise, the cash flow from operations fell by US$ 45 million from the previous year.

Nonetheless, this has translated into a net profit of US$ 102 million, according to Generally Accepted Accounting Practices. This is compared with US$ 75 million for 2023, an increase of US$ 27 million or 36%. But the Operational Earnings Before Interest, Taxes, Depreciation and Amortisation dropped to US$ 26 million, compared with US$ 45 million for 2023, a decrease of US$ 19 million or 42%. Kodak blames this on lower volumes and higher manufacturing costs together with changes in inventory reserve. Naturally Kodak also blames costs associated with investments in information technology systems and organizational restructuring – the same line also appeared in last year’s results, and most of the quarters since. Kodak also incurred costs associated with exhibiting at Drupa and certain litigation matters, presumably fighting off Fujifilm’s continuing lawsuit over patents around offset plates.

David Bullwinkle, Kodak’s CFO, is quoted in the accompanying press release as saying, “The company’s revenue for the year reflects a decline but is in line with expectations as we continue to concentrate on delivering improved gross profit. In the next year, we continue to focus on our growth areas and converting our historical investments into returns for the long term.”

Kodak is split into two divisions; one deals with print, while everything else, mostly film and chemicals, come under the Advanced Materials and Chemicals division or AMC. There’s plenty of good news at AM&C, where the revenues rose from US$ 255 million in 2023 to US$ 271 million in 2024 and the operational EBITDA grew from US$ 10 million to US$ 17 million. This is likely to improve over the course of this year as the company moves into pharmaceutical production, having now completed a new Current Good Manufacturing Practices or cGMP facility that will be used to manufacture diagnostic test reagents. This is due to start production shortly, which should be reflected in the next quarter’s results.

Unfortunately the picture is not so rosy in the Print division, where revenues fell from US$ 828 million in 2023 to US$ 737 million in 2024, and the operational EBITDA went from US$ 20 million in the black to US$ 8 million in the red. This has been a continuing theme now for several quarters.

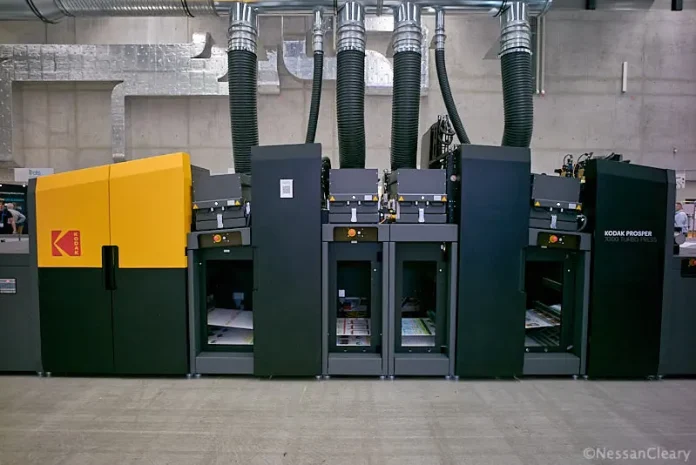

This is surprising, given that Kodak showed off its Ultra 520 inkjet press at last year’s Drupa, and brought along its Prosper 7000 Turbo to this year’s Hunkeler Innovation Days. Sitting next to the Prosper, Continenza told me, “I like to build what others can’t. It was important for the company mentally to come out with two new products that are better than any we have ever made.” He characterizes the Ultra 520 as being aimed mainly at the commercial offset market, noting, “The Prosper 7000 is faster but not the same print quality.”

However, Kodak does have an issue in getting these presses to market, which Continenza describes as a controlled introduction. The first and so far only Prosper 7000 Turbo is located at Mercury Print in the US where it was installed two years ago. He says that Kodak could have shipped the press three years earlier but that he insisted on ironing out any potential issue but added, “If you are going to do a real study then it has to be in the customer’s place. We needed to understand what was happening. The machine can work great in the factory but at the customer it depends on the quality of their staff.”

I pointed out that if he could get the presses to market faster then the results for the Print division might make for happier reading. But he answered, “For us it’s the total customer experience, not the money. We look at the world differently. Our model is total company profitability and I don’t look at it by product. I don’t run it like that. We run it as print is part of the product.”

Essentially that philosophy means that Continenza is willing to weather a drop in profitability in the print division because the AMC part of the business is doing so well. But he also sees Kodak’s print portfolio as a single entity rather than disparate technologies. He continually stressed to me that the same customers wanted both the digital print and the analog plates and CtP, pointing out, “We are helping the printers redesign their print shop. We are not just selling product. The 520 is replacing all offset. And Mercury also buys our plates but they will move more jobs to the digital.”

That assumes that the Ultra and Prosper presses are good enough to replace offset presses, and that Kodak can persuade those customers buying its plates to switch to its digital presses. That’s a tricky proposition since many single pass inkjet presses have simply replaced older digital devices, or even multiple digital printers. Only the B3 offset market has really given way to digital, forcing Heidelberg to offer its own inkjet press in the Jetfire 50. Some vendors, notably Landa and HP have had some success at replacing offset presses with inkjet machines but they are just scratching the surface, given the sheer number of offset presses that are installed worldwide.

That said, Kodak is not aiming for huge numbers of installations. Continenza told me, “Our goal is to have 5-10 Prosper 7000s and 10-15 of the Ultra 520s” He added, “We have one customer who is about to order six of the 520s. This customer is getting rid of analogue offset plates and going digital but we started working with them five years ago because you have to work around the equipment capex.” This is presumably the same unnamed customer that was announced back at Drupa, though at that time the order was for five not six presses.

Those numbers are not very ambitions but the rational behind this is that the presses are so fast that they are consuming a lot of ink, as he explains, “None of us make money on the hardware. We want the big customers because we make money from the ink.” He added, “And the customers that buy these printers are all big companies so that means more ink and a lot more other business so I can also sell them workflow and CtP.”

The ink is also the key to the current sales plan for the digital presses. Kodak has continually refined the ink for these presses over the last couple of years and this has allowed Kodak to position these presses for more high end applications where customers might be able to justify their cost. Continenza noted, “The ink got better. The fact that it can do those photobooks means that people can buy it for that quality. That was a big breakthrough for us.”

Last year when I chatted with Continenza we talked about packaging as a potential market for the 520 but now he says that this is not a focus for the 520, adding, “I changed my mind.” He explained, “We were trying to make it do too much. It does offset quality. So we are looking at high end direct mail, photo books, anything that adds high end differentiation.”

And, as he pointed out, Kodak also sells a lot of imprinting heads that can be added to analog presses or finishing equipment, noting, “We put the heads on a line and that’s a better solution than making a machine from scratch. And with GSS I have an integrator that I didn’t have before.”

For all this the fact remains that Kodak’s Print division is punching below its weight. It’s several years now since both the inkjet presses were first announced yet the company seems no closer to actually realizing installations and profits. Yet the plan going forward seems to be more of the same.

Continenza’s summary to the financial report stated, “One of our key investment areas, our AM&C group’s new cGMP facility for manufacturing regulated and unregulated pharmaceutical products, is scheduled to begin production this year. Our film business continues to grow, and we are investing in additional capacity to meet demand. In our print business, we have completed the tariff petition process with the US International Trade Commission, which has improved predictability for Kodak and our customers and brought fair competition to the plates market. Kodak can compete with anybody when there’s a level playing field.”

It’s also worth noting that Kodak has just announced that it will start manufacturing the latest iteration of its Sonora plates, the Ultra Process Free Plate, at its Osterode plant in Germany. The Sonora Ultra plates were announced at Drupa and promise improved image contrast, better white light exposure tolerance, and longer storage.

But Continenza concluded his press statement, “Our digital print business made a splash recently at the Hunkeler Innovation days tradeshow where we featured live demos of our Kodak Prosper 7000 Turbo Press, the world’s fastest inkjet press. For the balance of 2025, we’ll continue to improve efficiency through automation and support our customers with industry-leading solutions from all our businesses.”

This does not suggest that Kodak is planning to install many new presses this year, which is the one thing that would really improve the results at the Print division. But of course that only matters to those looking at this from the print industry perspective. Kodak is likely to see healthier results starting from the next quarter as the pharmaceutical production starts, leading to better headlines all around.

In the meantime, you can find Kodak’s results on its investors webpage and more information on the business overall from the main kodak.com site.

First published in the Printing and Manufacturing Journal on 28th March 2025. Republished with permission.